Paradice Australian Equities Fund May 2025 Commentary

Market Review

The S&P/ASX 300 Total Return Index rebounded 4.2% over May 2025, supported by easing trade tensions. The S&P500 Total Return Index meanwhile rose 6.3% (in USD) during the month.

Global trade relationships and tariffs remain a moving target as the USA attempts to reset trade relations with all major trading partners simultaneously. The USD failed to recover and was flat over the month, as concerns mounted that Trump’s erratic policy decisions may have damaged the U.S. dollar’s reserve status. Gold was also flat over the month as investors sought safe-haven assets.

Across the ASX200, Information Technology was the best performing sector +19.8%, underpinned by stocks such as Life 360, Technology One and Xero. Utilities, Consumer Staples and Health Care were laggards.

In Australia the RBA cut rates by 25bps to 3.85% noting that inflation is within the target range whilst citing weaker global growth as a potential risk. Three more rate cuts are anticipated before the end of 2025 by the bond market. The 2025 Australian federal election reaffirmed the Australian Labour Party in a landslide victory. Overall government policies are modestly stimulatory and reflect Labour’s continued push towards lowering cost of living (e.g. extending energy rebates, bulk billing expansion). The Fair Work Commission also announced a 3.5% increase in the national minimum wage effective 1 July 2025. This covers approximately 20% of the Australian work force and importantly ensures real wage growth above inflation.

Performance

The Paradice Australian Equities Fund was down 39ps net of fees vs the benchmark1 for the month of May 2025. Top 3 contributors were Catapult, Seek and Qantas (all overweight position). Top 3 detractors were Treasury Wine Estate, Newmont and Block (all overweight).

Noteworthy industry / macro developments

#1. USD under pressure, safe haven status challenged

Despite a sharp rebound in global equities, with the S&P500 rising to within 3% of all-time high (reached in Feb-25), the USD has persistently faced downward pressure.

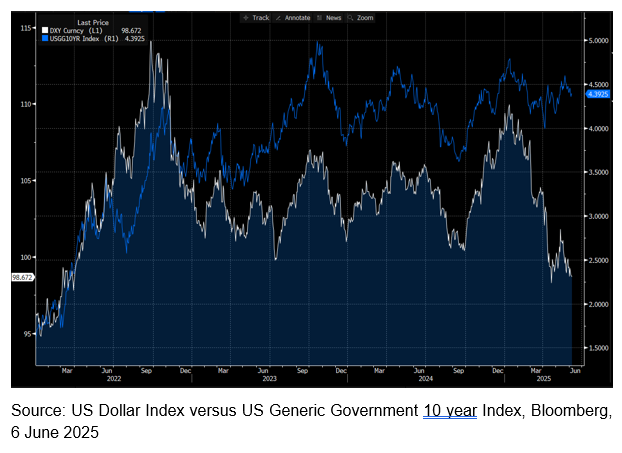

The following chart shows the relationship between the US 10-year government bond yield (blue line) and the USD (white line). Whilst there has been somewhat of a loose correlation historically, there has been a clear divergence to date in 2025.

Several reasons likely drive this:

- Fiscal concerns around US debt: The national debt surpassed US$35 trillion, just as cUS$9 trillion will be refinanced in 2025 against a backdrop of higher US interest rates. US interest payments are likely to rise to cUS$1 trillion in 2025, amplifying an already sizeable fiscal gap. This is exacerbated as foreign investors reduce holdings of Treasury bonds, forcing issuances at possibly higher rates.

- Weakening investor confidence due to political instability and trade uncertainty: Inconsistent and unpredictable trade policies are creating market unpredictability. We note Moody’s Ratings became the third and final credit rating to downgrade the S. government’s debt from its top rating by one notch from Aaa to Aa1.

- Rising share of alternatives to the USD: The dollar’s share of global foreign exchange reserves has been declining from over 70% in 2000 to 58% as at the end of 20242, reflecting a gradual shift towards alternatives like the euro, yuan and gold. Geopolitical shifts such as sanctions on Russia, and US-China tensions have accelerated efforts by nations to diversify away from dollar dependency, undermining its dominance. A lower USD makes imports more expensive and possibly exacerbates inflationary pressures in the US.

#2. Possible reallocation of capital flow away from US to Rest of the World

According to a recent report, which cited EPFR data, there have been cUS$2.5 trillion inflows to US assets (treasuries, corporate bonds), and US$1.3 trillion inflows into US stocks alone since 2020. The Fed Flow of Funds showed foreign investors owning sizeable levels of US stocks . This may mean that a small reallocation away from US stocks could have a positive impact on other global markets including Australia. Anecdotally this could be a factor driving up share prices of large, liquid Australian companies such as Commonwealth Bank and Wesfarmers.

#3. Troughing office market?

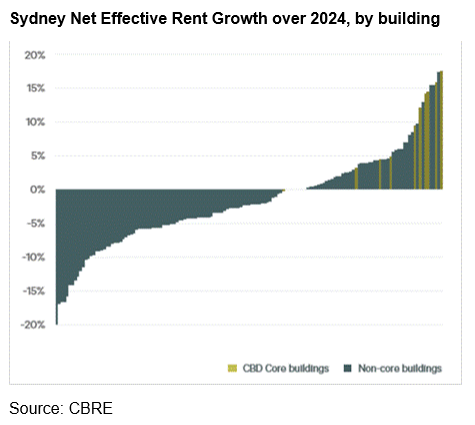

The Australian office market has been confronted with a valuation declines of up to 25% since their peak in 2022, reflecting factors such as high interest rates, low occupancy due to work from home and oversupply.

We are cautiously optimistic the office market has broadly troughed, with most listed REITs reporting an office cap rate of 6.0-6.5%, c200-250bps above the Australian 10-year government bond yield, in line with the historical premium.

However, as the following chart from CBRE shows, there is extreme bifurcation in net effective rent growth depending on whether the building is super prime (key streets of the CBD), A grade or B grade. Positively, whilst incentives and refurbishment costs remain high, the bid ask spread for office transactions have narrowed and we expect to see the return of transaction activity.

As such we remain selective in picking office REITs, with a focus on asset quality and sustainable cashflow.

For further details on fund positioning please refer to the Paradice Australian Equities Quarterly Fact Sheet.

1Benchmark is the S&P/ASX 200 Total Return Index

2IMF Foreign Exchange Holdings in US Dollars (Not Seasonally Adjusted)

Disclaimer:

This material is prepared by Paradice Investment Management Pty Ltd (ABN 64 090 148 619 AFSL No 224158) (Paradice, we or us) to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information.

This material is not intended to constitute advertising or advice (including investment advice or security, market or sector recommendations) of any kind. In addition, this material represents only the views of the Paradice Australian Equities team as at the time of release and is not intended, and may not, represent the views of Paradice or any of the other investment teams at Paradice.

Equity Trustees Limited (ABN 46 004 031 298, AFSL No. 240975) (Equity Trustees) is the responsible entity of, and issuer of units in, the Paradice Australian Equities Fund (Fund). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX:EQT).

It may contain certain forward looking statements, opinions and projections that are based on the assumptions and judgments of Paradice with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Paradice. Because of the significant uncertainties inherent in these assumptions, opinions and judgments, you should not place undue reliance on these forward looking statements. For the avoidance of doubt, any such forward looking statements, opinions, assumptions and/or judgments made by Paradice may not prove to be accurate or correct. You should perform your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. Specific securities identified herein are not representative of all securities purchased, sold, or recommended by the Fund previously or in the future. Following publication of this material, the investment teams at Paradice may transact or continue to transact in any of the securities covered herein, and may be positive, negative or neutral at any time hereafter regardless of our initial conclusions, or opinions.

The content of this publication is current as at the date of its publication and is subject to change at any time. It does not reflect any events or changes in circumstances occurring after the date of publication.

You should consider your own needs and objectives and consult with a licensed financial adviser when deciding whether the Fund is suitable for you. Past performance should not be taken as an indicator of future performance. You should also read the current Product Disclosure Statement before making a decision about whether to invest in this product and the Target Market Determination available at www.paradice.com . A Target Market Determination is a document which describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. This material is not to be copied, reproduced or published at any time without the prior written consent of Paradice. Neither Paradice, Equity Trustees, nor any of their respective related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained in this publication or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material.

The information and opinions contained herein, including information obtained from third party sources which are considered to be reliable, are not necessarily all-inclusive and, as such, no representation or warranty, express or implied, is made as to the accuracy, completeness or reasonableness of any assumption contained herein and no responsibility arising for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Paradice, its officers, employees or agents.

Copyright© 2025 Paradice