Paradice Australian Equities Fund September 2025 Commentary

Performance

The portfolio returned 837bps, outperforming the ASX200 by 366bps over the quarter net of fees.

Key Contributors/Detractors

Positives

- Newmont (NEM) Overweight – outperformed on a surging gold price and record free cash flow.

- Lynas (LYC) Overweight – jumped on a US Department of Defence deal with MP Materials, the first evidence of an ex-China rare earth supply chain being established.

- CBA (CBA) Underweight – de-rated on weaker than expected Net Interest Margin guidance.

- Seek (SEK) Overweight – rose on higher yield progress and evidence of operating leverage for the first time in many years.

- Electro Optic Systems (EOS) Overweight – outperformed on significant new orders related to laser counter drone capabilities.

Negatives

- Xero (XRO) Overweight – underperformed on concerns AI could disrupt its competitive position.

- Westpac (WBC) Underweight- advanced on a solid core Net Interest Margin and beat from volatile Markets.

- Treasury Wine (TWE) Overweight – underperformed soft Chinese and US demand trends and distribution changes in California.

- Insurance Australia Group (IAG) Overweight – underperformed on broader financials sell-off.

- ANZ Group (ANZ) Underweight – advanced on cost out and restructuring announcements.

Key Portfolio Changes

Purchases

- BHP (BHP) – increased as the outlook for its Iron re and Copper improved.

- Newmont (NEM) – preferred exposure to Gold due to a stable production profile.

- Brambles (BXB) – increased as asset efficiency initiatives continue to underpin strong earnings growth and portfolio defensiveness was increased.

- A2 Milk (A2M) – increased post clarity around downstream acquisition and continued evidence around market share gain in China.

- Life 360 (360) – new position. A fast-growing family safety app with new revenue opportunities including advertising, pets and elderly.

Sales

- ResMed (RMD) – trimmed due to strong performance.

- Commonwealth Bank (CBA) – increased the underweight position as the rotation from banks to resources gathered momentum.

- South 32 (S32) – sold on declining alumina prices and operational issues in Western Australia.

- Cleanaway (CWY) – exited on lower confidence in earnings delivery.

- Woodside (WDS) – exited on a deteriorating oil and LNG outlook.

Market Review

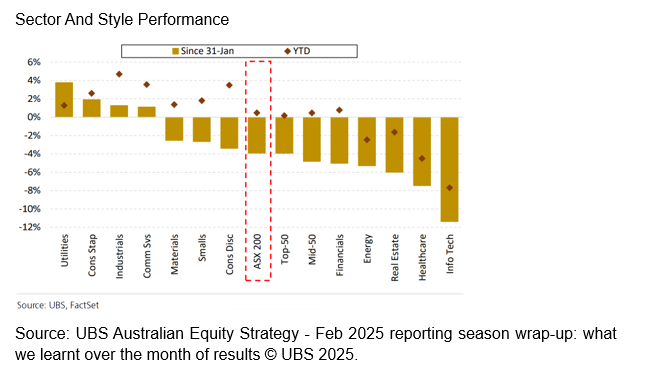

During the quarter, the S&P/ASX 200 Total Return Index gained 4.7%. Materials rose 20.5% mostly due to strength in Gold producers. Consumer Discretionary lifted 10.0% as tax cuts and the rates outlook lifted customer demand. Healthcare dropped 9.3% weighted by CSL and continued uncertainty around US pharmaceutical tariffs.

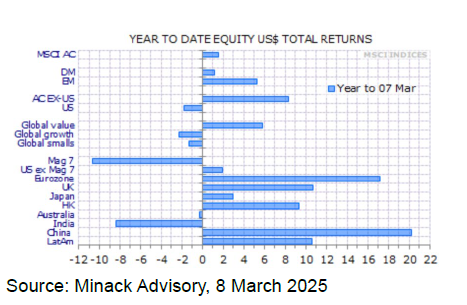

The S&P 500 gained 8.1% (in USD) in the September quarter vs pcp. Markets were buoyed by a 25bp U.S. Federal Reserve rate cut and continued optimism around Artificial Intelligence (AI) spend. MSCI China Total Return Index leapt 20.7% (in USD) as policy measures stabilised sentiment.

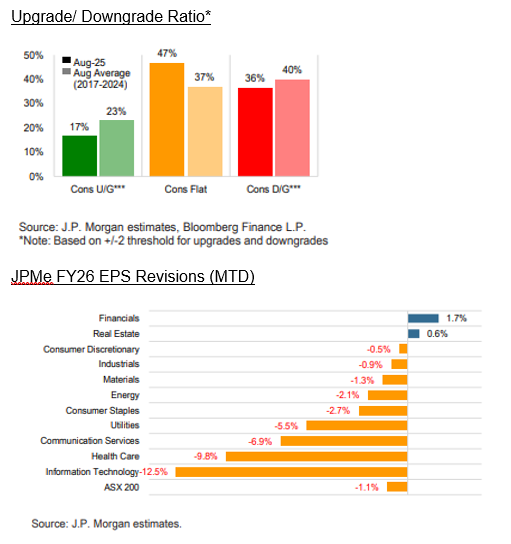

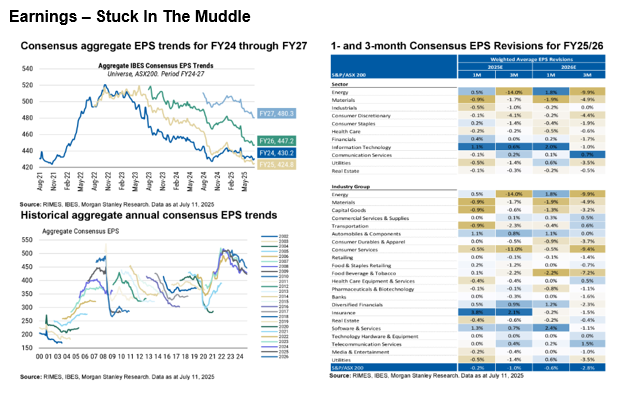

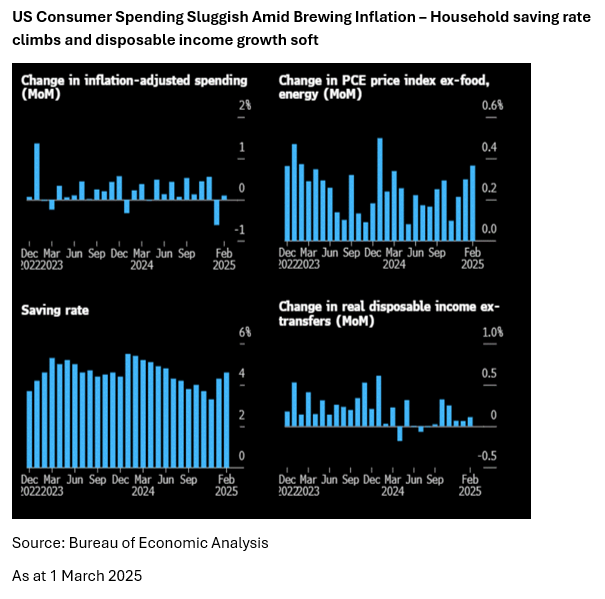

The Australian reporting season was very volatile, especially for large cap stocks that missed expectations on outlook e.g. CSL, James Hardie, and Woolworths. Net, earnings growth expectations across the S&P/ASX 200 for FY26 were downgraded by c2% to +6.5%, with most sectors experiencing downgrades with the exception of Real Estate and Financials. Companies called out Victoria as suffering weak demand due to high taxes, poor productivity and consumer theft. The results also conveyed a soft consumer and housing environment in the US, with companies citing lower fast-moving-consumer-goods (FMCG) volumes, softening US house prices and sales activity. The industrial names Brambles and Ansell performed well due to underlying productivity improvements which helped margins and cashflow.

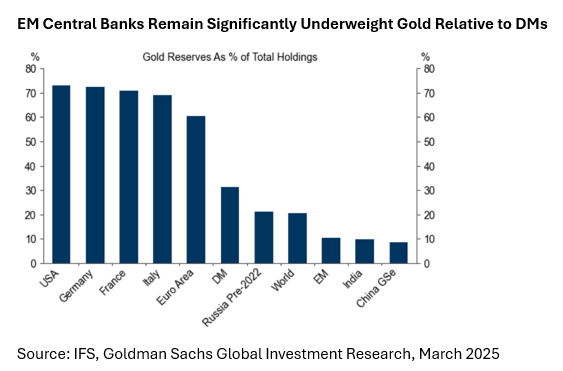

The Bloomberg Commodities Index ticked up 3.6% (in USD). Gold rose 16.8% (in USD) on central bank demand. Iron Ore rose 9.6% on Chinese stimulus and Lithium 9.5% on inventory restocking (both in USD). Brent crude oil eased 0.9% as OPEC+ raised supply and LNG dropped 15.8% on soft demand due to mild weather (all in USD).

Outlook

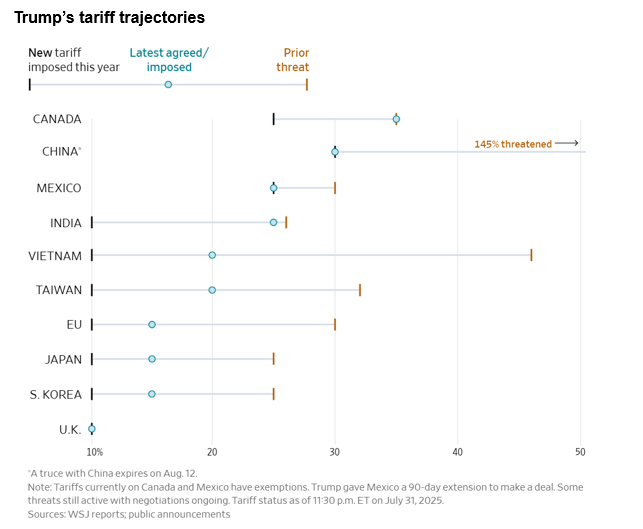

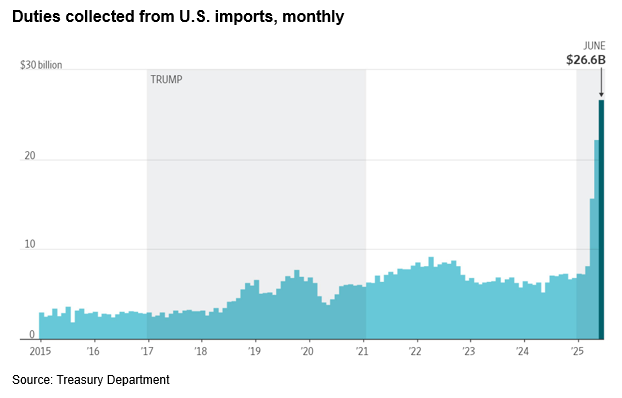

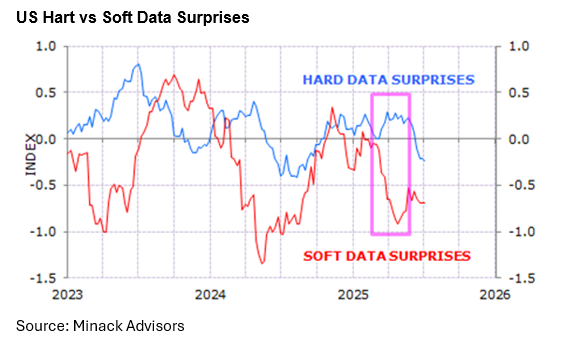

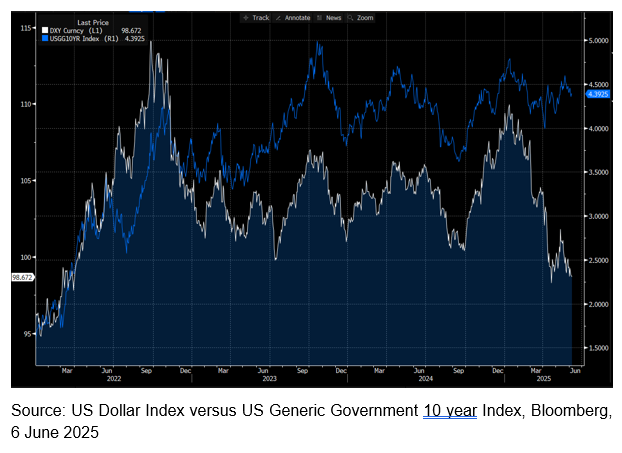

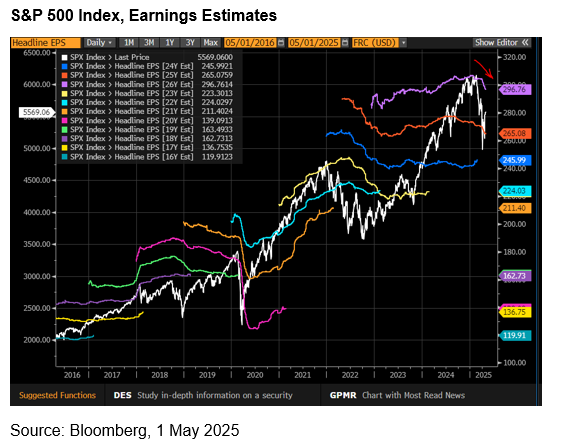

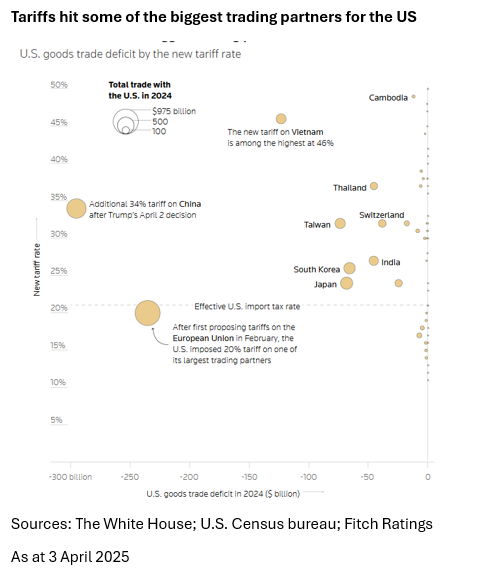

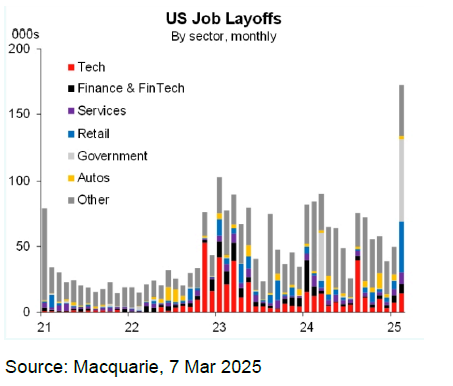

We are moderately cautious on short-term market prospects due to a combination of exuberance around AI stocks, extended valuations in equities, and emergence of softer consumer and employment conditions in the U.S., just as tariff policies kick into effect. Recent volatility in the long end of the yield curve and surging Gold prices also portend some level of risk off / aversion may be pending. The US S&P500 market is trading on an expensive 25.0x December 2025 Price/Earnings ratio.

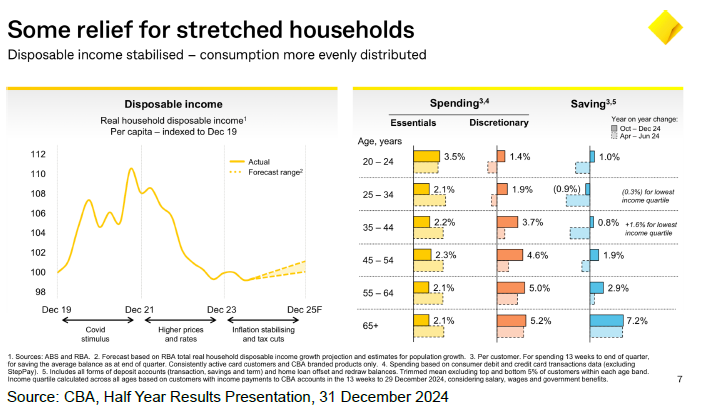

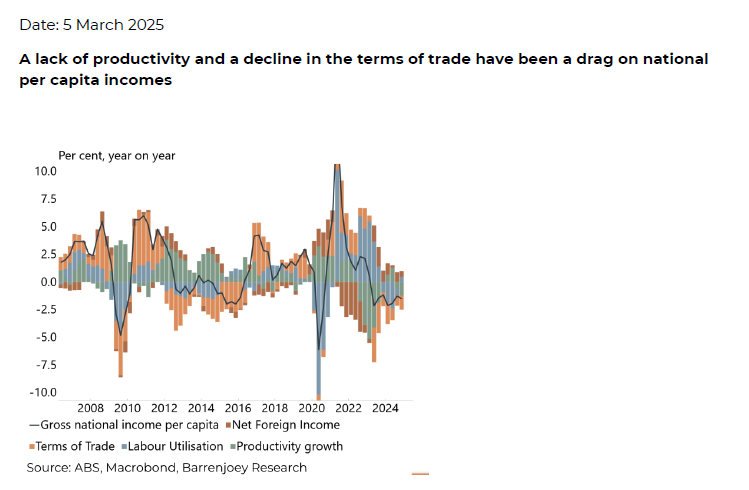

On the economic front, the U.S. data has been mixed of late resulting in the Fed’s evolving stance towards interest rate cuts. Futures are pricing ~50bp more of cuts by year-end, which may support economic activity. In Australia, the economic picture is also resilient with signs that the domestic consumer is in good shape after an 18-month period of ‘cost of living’ increases. We are seeing signs of job ad declines moderating and consumer discretionary spending increasing, which all point to a consumer in reasonable shape. However, the recent jump in inflation to 3.0% in August, and ‘hawkish’ commentary from the RBA in September, has resulted in a pushout of rate cut expectations to April 2026, so the economy is unlikely to benefit from any further rate relief short-term. The Australian economy is expected to grow real GDP at a modest 2.2% in 2026.

Portfolio Positioning

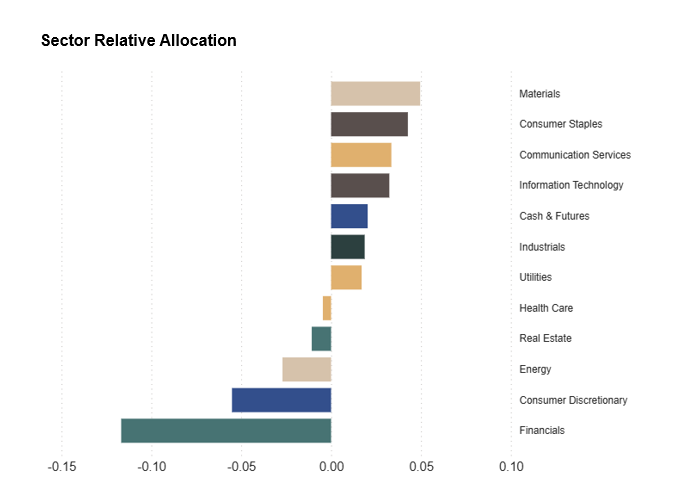

The portfolio’s active positioning by sector as of 30 September 2025 is as follows.

As at 30 September 2025. Paradice portfolio sector assignment is based on GICS. Source: Factset and Paradice. Relative allocation is based on the market value of each position expressed as a % of the total portfolio relative to benchmark weights.

Top 5 active positions (Overweight)

- Newmont

- BHP

- Seek

- Coles

- Xero

The portfolio is modestly defensively positioned given the confluence of: 1) persistent momentum in the way of PE expansion with no apparent catalyst to derail this; albeit 2) extended valuation as a starting point; 3) signs of soft employment and consumer and housing demand in US.

The portfolio is overweight Materials principally due to favourable views on Gold (via Newmont and Northern Star) given continual central bank buying, and rare earth (via Lynas). The US Department of Defence’s deal with MP Materials provides clear evidence of an ex-China rare earth supply chain being established to provide the US with self-sufficiency as rare earths is a key input into defence equipment such as sensors, motors, lasers, and magnets.

Within Communications, Seek is a name where we have increased conviction post results. Despite a lacklustre job growth environment in Australia and Asia, Seek increased its placement share and achieved double digit yield growth through higher ad tiers and new products, which bodes even better for operating leverage when volumes do return to growth. We also anticipate the market to attribute greater value to Seek’s Growth fund as the liquidity window draws near.

The portfolio also added a number of smaller Technology stocks where we see strong growth and attractive valuation. Qoria was an example, it is a globally leading software player in student online safety specialising in monitoring and intervention of inappropriate content. This is a large addressable market supported by regulation, and Qoria is growing strongly through growth in school adoption and cross-selling of multiple products.

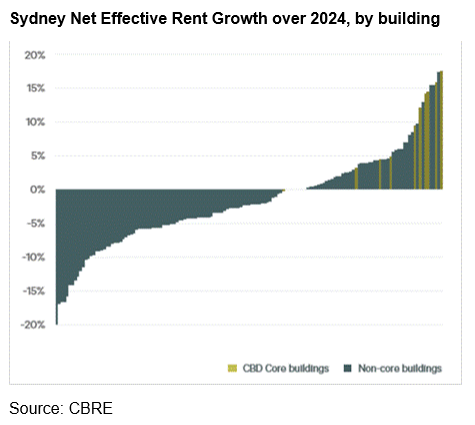

The portfolio is underweight Financials principally due to Banks where valuations are at very stretched levels despite a lacklustre earnings growth profile.

For any other questions in relation to the portfolio, please contact distribution@paradice.com.

For further details on fund positioning please refer to the Paradice Australian Equities Quarterly Fact Sheet.

Disclaimer:

This material is prepared by Paradice Investment Management Pty Ltd (ABN 64 090 148 619 AFSL No 224158) (Paradice, we or us) to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information.

This material is not intended to constitute advertising or advice (including investment advice or security, market or sector recommendations) of any kind. In addition, this material represents only the views of the Paradice Australian Equities team as at the time of release and is not intended, and may not, represent the views of Paradice or any of the other investment teams at Paradice.

Equity Trustees Limited (ABN 46 004 031 298, AFSL No. 240975) (Equity Trustees) is the responsible entity of, and issuer of units in, the Paradice Australian Equities Fund (Fund). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX:EQT).

It may contain certain forward looking statements, opinions and projections that are based on the assumptions and judgments of Paradice with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Paradice. Because of the significant uncertainties inherent in these assumptions, opinions and judgments, you should not place undue reliance on these forward looking statements. For the avoidance of doubt, any such forward looking statements, opinions, assumptions and/or judgments made by Paradice may not prove to be accurate or correct. You should perform your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. Specific securities identified herein are not representative of all securities purchased, sold, or recommended by the Fund previously or in the future. Following publication of this material, the investment teams at Paradice may transact or continue to transact in any of the securities covered herein, and may be positive, negative or neutral at any time hereafter regardless of our initial conclusions, or opinions.

The content of this publication is current as at the date of its publication and is subject to change at any time. It does not reflect any events or changes in circumstances occurring after the date of publication.

You should consider your own needs and objectives and consult with a licensed financial adviser when deciding whether the Fund is suitable for you. Past performance should not be taken as an indicator of future performance. You should also read the current Product Disclosure Statement before making a decision about whether to invest in this product and the Target Market Determination available at www.paradice.com . A Target Market Determination is a document which describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. This material is not to be copied, reproduced or published at any time without the prior written consent of Paradice. Neither Paradice, Equity Trustees, nor any of their respective related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained in this publication or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material.

Copyright© 2025 Paradice

Comments