August, 2024

Report: Is there an opportunity to invest in Australian Small Caps now?

Paradice Australian Small Cap Opportunities Fund

Are US small cap stocks setting the scene?

There has been a lot of commentary and media recently talking about the great rotation currently underway globally out of large caps and into small caps.

Below is a chart of the Russell 2000 (blue line; representing US Small Caps) vs the S&P 500 (white line; US Large Caps) over the last month, which illustrates close to a 10% performance difference between the two indices.

(Source: Internal, Bloomberg, as at 1 August 2024)

Why might this rotation be happening and what does it mean in an Australian context?

- In our view, AI is an expense at the moment rather than a revenue generator. This goes to the cost of building out the infrastructure for AI and the lag as capacity fills up before returns come.

- Concentration risk may be playing out. The 10 largest stocks by market capitalisation in the S&P 500 accounted for 27% of the index at the end of 2023, nearly double the 14% share of a decade earlier (source: Morgan Stanley). This has increased to 37% in 2024 according to FactSet data, with the Magnificent Seven making up 31% of the index. That rate of increase in concentration is the most rapid since 1950, according to Morgan Stanley. In our view the Magnificent Seven will have to keep positively surprising on earnings to maintain that momentum.[1]

- The rotation began after the June 2024 CPI. In our view, this will get stronger when interest rate cuts begin to materialise and the move in US small caps over the last month suggests conviction on the rotation growing, a trajectory which could play out similarly in an Australian context as outlined below.

Interestingly, in Australia, we have not yet seen this play out at the index level – with Small Caps (the blue line in the chart below) only slightly ahead vs the ASX100 over the last month.

(Source: Internal, as at 1st August 2024)

There are probably a number of reasons why this might be the case, but typically what we are seeing transpire in the US could follow here with a lag, depending somewhat on the local interest rate cycle.

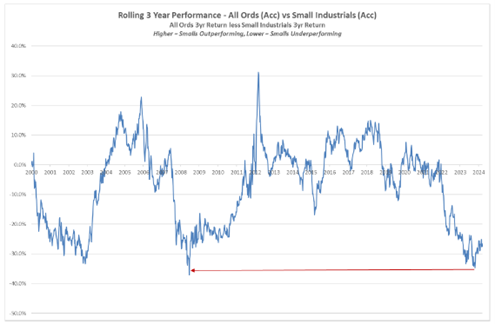

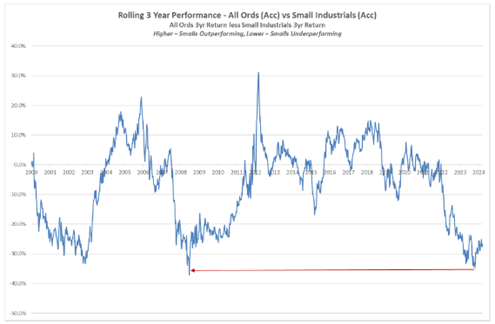

And if we do see a catch up here in Australia, the scale is likely to be quite big – given the level of underperformance we have seen over the past 3 years:

(Source: Internal to Paradice, as at 31 July 2024)

Paradice Australian Small Cap Opportunities Fund (“SCOF” or “the Fund”) turned one on 20 July 2024

Why consider an investment in SCOF?

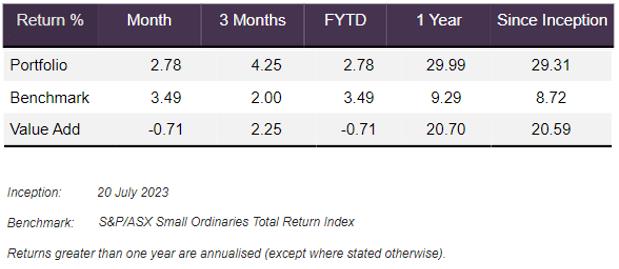

- Fund Performance: SCOF has performed strongly in its first 12 months; delivering 29.99% total return, 20.70% above benchmark return of 9.29% (being the S&P/ASX Small Ordinaries Total Return Index. Refer also to table below).[2]

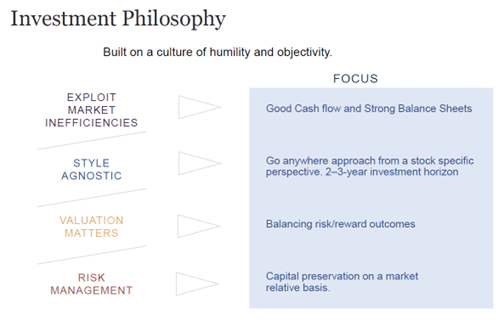

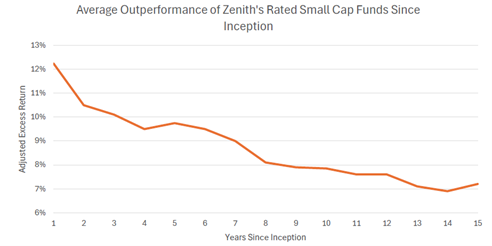

- Investment Philosophy/Process: SCOF employs a similar process to the original Paradice Small Cap Fund founded in 2000; which has delivered >14% p.a. total return over this time.[3]

- Fund Size: SCOF has a relatively small FUM allowing it to be nimble, take advantage of mispricing while focusing on capital preservation and compounding returns.

- Boutique Structure: As a Paradice product, SCOF is able to leverage off the wider Paradice network.

- The Australian Small Cap Index[4] has materially underperformed Large Caps[5] by c.25% since interest rates started rising in early 2022. With rates close to a peak; and early signs of a small cap re-rate occurring in the US; now is a good time consider investing in Australian Small Caps in our view.

1) Fund Performance:

SCOF celebrated its one year anniversary on 20 July 2024.

For the year to 31 July 2024 the Fund delivered a c30% total return before tax, after ongoing management costs and accrued performance fees.

31 July 2024

Past performance of the Fund is not a reliable indicator of future performance. The value of an investment in the Fund may rise or fall. Returns are not guaranteed by any person. Fund returns are calculated before tax, after ongoing management costs and any accrued performance fees (unless waived). Returns greater than 1 year are annualised.

2) Investment philosophy/process:

As at 30 June 2024, the existing Australian Small Cap Fund has returned 14.9% total gross return and 9.34% alpha per annum over 24 years.[3]

SCOF implements a similar investment philosophy to that implemented successfully by the other Paradice Funds – including the existing Australian Small Cap Fund.

3) Fund size:

SCOF is a capacity constraint product – we will limit FUM to maximise alpha generation.

Further we are at the early stage of SCOF’s life cycle, which has obvious benefits:

– increased nimbleness to trade in and out of stocks; and

– broader investment opportunities.

4) Boutique structure supported by the wider Paradice business:

The investment team behind SCOF are co-investors in the Fund alongside our clients, which creates strong alignment. SCOF can also leverage the wider Paradice funds management network.

5) Time for Australian small caps?

With the Australian Small Cap Index near 15-year lows; and the early stages of a potential re-rate underway in US Small Caps; now could be an opportune time to invest in Australian Small Caps.

[1] Source: How Magnificent 7 affects S&P 500 stock market concentration (cnbc.com))

[2] Past performance of the Fund is not a reliable indicator of future performance. The value of an investment in the Fund may rise or fall. Returns are not guaranteed by any person. Fund returns are calculated before tax, after ongoing management costs and any accrued performance fees (unless waived). Returns greater than 1 year are annualised.

[3]Returns presented on a “gross” basis do not reflect any management fees, and other potential expenses to be borne by the investors. The Australian Small Cap Fund is managed by a separate investment team and is distinct from the Australian Small Cap Opportunities Fund.

[4] The S&P/ASX Australian Small Industrials Index.

[5]The S&P/ASX Australian All Ordinaries Index.

Disclaimer:

This material is prepared by Paradice Investment Management Pty Ltd (ABN 64 090 148 619 AFSL No 224158) (Paradice, we or us).

This material is not intended to constitute advertising or advice (including investment advice or security, market or sector recommendations) of any kind. In addition, this material represents only the views of the Paradice Australian Small Cap Opportunities team as at the time of release and is not intended, and may not, represent the views of Paradice or any of the other investment teams at Paradice.

Equity Trustees Limited (ABN 46 004 031 298, AFSL No. 240975) (Equity Trustees) is the responsible entity of, and issuer of units in, the Paradice Australian Small Cap Opportunities Fund (Fund). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX:EQT).

It may contain certain forward looking statements, opinions and projections that are based on the assumptions and judgments of Paradice with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Paradice. Because of the significant uncertainties inherent in these assumptions, opinions and judgments, you should not place undue reliance on these forward looking statements. For the avoidance of doubt, any such forward looking statements, opinions, assumptions and/or judgments made by Paradice may not prove to be accurate or correct. You should perform your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. Specific securities identified herein are not representative of all securities purchased, sold, or recommended by the Fund previously or in the future. Following publication of this material, the investment teams at Paradice may transact or continue to transact in any of the securities covered herein, and may be positive, negative or neutral at any time hereafter regardless of our initial conclusions, or opinions.

The content of this publication is current as at the date of its publication and is subject to change at any time. It does not reflect any events or changes in circumstances occurring after the date of publication.

You should consider your own needs and objectives and consult with a licensed financial adviser when deciding whether a Paradice Fund is suitable for you. You should also read the current Product Disclosure Statement and Target Market Determination available at www.paradice.com. A Target Market Determination is a document which is required to be made available by 5 October 2021. It will describe who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It will also describe the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.

This material is not to be copied, reproduced or published at any time without the prior written consent of Paradice. Neither Paradice, Equity Trustees, nor any of their respective related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained in this publication or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material.

The information and opinions contained herein, including information obtained from third party sources which are considered to be reliable, are not necessarily all inclusive and, as such, no representation or warranty, express or implied, is made as to the accuracy, completeness or reasonableness of any assumption contained herein and no responsibility arising for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Paradice, its officers, employees or agents.

Equity Trustees nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it

Copyright© 2024 Paradice

Contributors:

Sam Theodore

Head of the Australian Small Cap Opportunities Fund

Michael Peet

Portfolio Manager of the Australian Small Cap Opportunities Fund