Paradice Australian Equities Fund April 2025 Commentary

Market Review

The S&P/ASX 300 Total Return Index fell 6.4% over the first five days of April following tariff announcements by President Trump, only to rally 10.7% and end the month up 3.6%. As markets initially reacted negatively, Trump softened his stance, suspending the implementation of tariffs for 90 days and offering concessions. This shift gave investors’ confidence that Trump may reverse course if sustained market declines occur.

Despite this, the USD failed to fully recover and declined 4.6% over the month, as concerns mounted that Trump’s erratic policy decisions may have damaged the U.S. dollar’s reserve status. Gold rose 5.3% (in USD) over the month as investors sought safe-haven assets. Unwinding this trade may prove more challenging.

The Federal Reserve may eventually offer some policy offset. However, with business pricing responses still uncertain and inflation unclear, any rate cut may be delayed in the near term. Our view remains that tariffs are ultimately a tax on consumers and pushes up prices of goods whilst dampening the growth outlook. Even if corporates relocated manufacturing to the US, it is not clear where the labour force would come from given c90% of the labour force is engaged in services, and whether the output could be priced competitively.

In Australia, the equity market impact of the Labor Party’s election victory is expected to be minor. Australia’s Q1 Trimmed Mean CPI was 0.7% q/q, placing annual inflation within the RBA’s 2–3% target band. Combined with tariff-related risks, this has led futures markets to price in a 25bp RBA rate cut in May.

Performance

The Paradice Australian Equities Fund was down 143bps net of fees vs the benchmark. Top 3 contributors were Woodside Energy (not owned), with overweight positions in Coles and Newmont. Top 3 detractors were Commonwealth Bank (underweight), Alcoa and Treasury Wine Estates (both overweight).

Noteworthy industry / macro developments

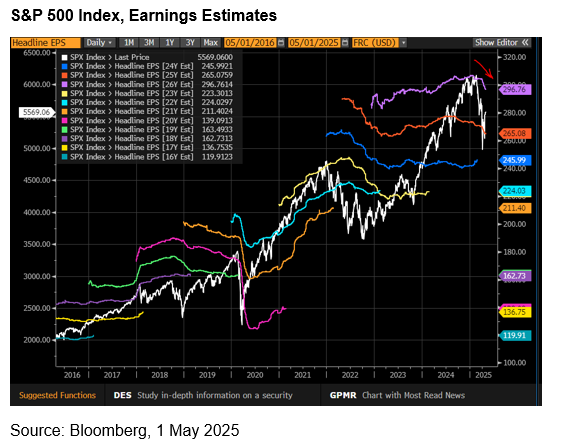

#1 Downward EPS revisions in US are starting to emerge

US corporates are starting to withdraw guidance or downgrade earnings as weaker consumer and business confidence is manifesting into lower spending. A few prominent examples include:

- Fast moving consumer goods – Procter & Gamble, Conagra Brands, Kraft Heinz adjusted volume outlook lower citing a volatile consumer environment.

- Food services – McDonalds, Chipotle lowered sales growth guidance noting consumers are reducing restaurant visits.

- Air travel – e.g. Delta Airlines, American Airlines, Southwest withdrew guidance for 2025 earnings due to macroeconomic uncertainty

- Automotives – Ford, General Motors lowered or withdrew guidance citing tariff cost impost.

- Payments – Block citing reduced gross profit outlook partly due to reduced consumer spending.

Some Australian corporates exposed to the US have also started to soften the outlook e.g. Reliance Worldwide Corporation, Flight Centre, Corporate Travel.

#2 Field trips to US and China

The team undertook field trips to the US and China during the month.

Meetings in Washington underscored the increasingly troubling state of the U.S. fiscal position.

The federal government is currently running an annual deficit of approximately US$2 trillion, driven by revenues of around US$5 trillion and expenditures near US$7 trillion. Of the total expenditure, only cUS$1 trillion encompasses some discretionary areas that may offer some scope for trimming. Trump, in collaboration with Elon Musk and the Department of Government Efficiency (DOGE), initially targeted US$2 trillion in spending cuts. That goal was quickly revised down to US$1 trillion, and then again to US$450 billion. As of May 7, with most of the DOGE-led activity seemingly concluded, the initiative has publicly claimed US$165 billion in savings—representing only about 8% of the current deficit.

Looking ahead, the fiscal picture has another challenge. The U.S. has approximately US$36 trillion in total debt, with around US$9 trillion maturing in 2025. This debt currently carries an average interest rate of 3.35%, but if it were to be refinanced at the prevailing 5-year Treasury rate of 3.9%, the resulting increase in interest costs would be roughly US$50 billion—effectively eliminating nearly one-third of the DOGE-reported savings.

This precarious fiscal outlook poses growing risks to the U.S. dollar’s status as the world’s reserve currency, providing further support for gold and our positions in Newmont and Northern Star.

Our trip to China suggests sentiment has improved post-stimulus despite geopolitical uncertainties. The government is shifting subsidies from traditional sectors to high-tech and green industries, while tightening control over private firms and prioritising employment at the expense of productivity. Consumers are trading down in luxury, favouring sportswear and mid-range Penfolds, while high-end malls struggle. Domestic travel is booming, and younger people are returning to smaller cities, boosting local growth. Property shows strength in Tier-1 and select Tier-2 cities, but lower-tier markets remain weak. EV sales have remained strong, led by low-end demand and rising premiumisation, with BYD expecting market consolidation.

Disclaimer:

This material is prepared by Paradice Investment Management Pty Ltd (ABN 64 090 148 619 AFSL No 224158) (Paradice, we or us) to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information.

This material is not intended to constitute advertising or advice (including investment advice or security, market or sector recommendations) of any kind. In addition, this material represents only the views of the Paradice Australian Equities team as at the time of release and is not intended, and may not, represent the views of Paradice or any of the other investment teams at Paradice.

Equity Trustees Limited (ABN 46 004 031 298, AFSL No. 240975) (Equity Trustees) is the responsible entity of, and issuer of units in, the Paradice Australian Equities Fund (Fund). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX:EQT).

It may contain certain forward looking statements, opinions and projections that are based on the assumptions and judgments of Paradice with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Paradice. Because of the significant uncertainties inherent in these assumptions, opinions and judgments, you should not place undue reliance on these forward looking statements. For the avoidance of doubt, any such forward looking statements, opinions, assumptions and/or judgments made by Paradice may not prove to be accurate or correct. You should perform your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. Specific securities identified herein are not representative of all securities purchased, sold, or recommended by the Fund previously or in the future. Following publication of this material, the investment teams at Paradice may transact or continue to transact in any of the securities covered herein, and may be positive, negative or neutral at any time hereafter regardless of our initial conclusions, or opinions.

The content of this publication is current as at the date of its publication and is subject to change at any time. It does not reflect any events or changes in circumstances occurring after the date of publication.

You should consider your own needs and objectives and consult with a licensed financial adviser when deciding whether the Fund is suitable for you. Past performance should not be taken as an indicator of future performance. You should also read the current Product Disclosure Statement before making a decision about whether to invest in this product and the Target Market Determination available at www.paradice.com . A Target Market Determination is a document which describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. This material is not to be copied, reproduced or published at any time without the prior written consent of Paradice. Neither Paradice, Equity Trustees, nor any of their respective related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained in this publication or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material.

Copyright© 2025 Paradice