Paradice Australian Equities Fund August 2025 Commentary

Market Review

The S&P/ASX 200 Total Return Index continued to strengthen, up by 3.1% over August 2025. The S&P500 Total Return Index meanwhile rose 2.0% (in USD) during the month.

Gold stocks were some of the best performers. Growing expectation that the Fed would ease policy, the weaker US Dollar (-2.2%), plus concerns about growing fiscal deficits have continued to support the gold price.

Within the ASX200, Materials (+9.2%) and Consumer Discretionary (+7.6%) led sector gains. Healthcare was (again) the worst performer, with a fall of 13.2%.

There were some very strong factor moves over reporting season, with Small Caps outperforming Large by +5.3%1. A domestic rate cutting cycle could continue to bolster earnings of small cap industrials and support this rotation.

Outlook

We are moderately cautious on markets in the short-term due to poor seasonality and extended positioning in equities. Recent moves in the long end of the yield curve and gold prices also portend some level of risk off / aversion may be pending. However, growing expectations of rate cuts in the US could support a continuation of the equities rally.

In Australia the economic picture is relatively more resilient with signs of the domestic consumer emerging in good shape from an 18-month period of cost-of-living increases. We are seeing signs of job ad declines moderating and consumer discretionary spending increasing which all point to a consumer in reasonable shape. We anticipate more domestic interest rate cuts will also support an acceleration in economic growth.

Performance

The Paradice Australian Equities Fund was up 530bps net of fees for the month of August 2025. Top 3 contributors were Newmont (overweight), CSL (underweight) and CBA (underweight). Top 3 detractors were Westpac (underweight), Xero (overweight) and ANZ (underweight).

Reporting season wrap:

August’s earnings season delivered plenty of volatility for Australian equities. Approximately a third of stocks that reported had an on-day share price reaction of more than 3 standard deviations. A number of ‘blue chips’ suffered near-record on-day declines, particularly CSL, JHX and WOW. Dramatic moves to the upside were also a regular feature of the season, with BXB, COL and QAN all gaining 9%+ on-day.

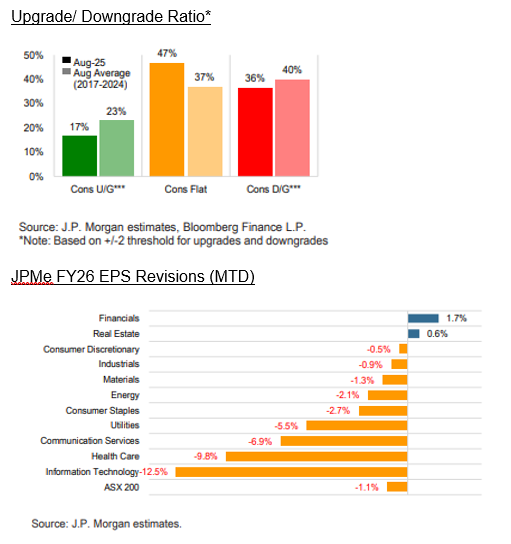

Downgrades dominated the reporting season, led by Technology (WTC) and Healthcare (CSL, RHC). Financials (WBC) and Real Estate were the only 2 sectors to post positive EPS revisions.

For further details on fund positioning please refer to the Paradice Australian Equities Quarterly Fact Sheet.

1 S&P/ASX Small Ordinaries Total Return Index versus the S&P/ASX 200 Total Return Index – August 2025.

Disclaimer:

This material is prepared by Paradice Investment Management Pty Ltd (ABN 64 090 148 619 AFSL No 224158) (Paradice, we or us) to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information.

This material is not intended to constitute advertising or advice (including investment advice or security, market or sector recommendations) of any kind. In addition, this material represents only the views of the Paradice Australian Equities team as at the time of release and is not intended, and may not, represent the views of Paradice or any of the other investment teams at Paradice.

Equity Trustees Limited (ABN 46 004 031 298, AFSL No. 240975) (Equity Trustees) is the responsible entity of, and issuer of units in, the Paradice Australian Equities Fund (Fund). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX:EQT).

It may contain certain forward looking statements, opinions and projections that are based on the assumptions and judgments of Paradice with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Paradice. Because of the significant uncertainties inherent in these assumptions, opinions and judgments, you should not place undue reliance on these forward looking statements. For the avoidance of doubt, any such forward looking statements, opinions, assumptions and/or judgments made by Paradice may not prove to be accurate or correct. You should perform your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. Specific securities identified herein are not representative of all securities purchased, sold, or recommended by the Fund previously or in the future. Following publication of this material, the investment teams at Paradice may transact or continue to transact in any of the securities covered herein, and may be positive, negative or neutral at any time hereafter regardless of our initial conclusions, or opinions.

The content of this publication is current as at the date of its publication and is subject to change at any time. It does not reflect any events or changes in circumstances occurring after the date of publication.

You should consider your own needs and objectives and consult with a licensed financial adviser when deciding whether the Fund is suitable for you. Past performance should not be taken as an indicator of future performance. You should also read the current Product Disclosure Statement before making a decision about whether to invest in this product and the Target Market Determination available at www.paradice.com . A Target Market Determination is a document which describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. This material is not to be copied, reproduced or published at any time without the prior written consent of Paradice. Neither Paradice, Equity Trustees, nor any of their respective related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained in this publication or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material.

Copyright© 2025 Paradice