Paradice Australian Equities Fund February 2025 Commentary

Market Review

The S&P/ASX 200 Total Return Index and S&P 500 Total Return Index were down -3.79% and -1.3% (in USD) respectively in February 2025.

The Paradice Australian Equities Fund was up 0.43 bps net of fees vs the benchmark. Top 3 contributors were A2 Milk, WiseTech and Goodman Group. Top 3 detractors were Block, IAG and Telstra.

Noteworthy industry / macro developments

#1 Reporting season volatility

The Feb-25 reporting season was one of the most volatile in recent times, with individual stocks reporting average intra-day swings of c7%. Multiple forces have likely contributed to this evolution in price behaviour (passive money, liquidity, stale earnings estimates). Interestingly this is synonymous with the increasing share price volatility we have observed in US markets in recent years.

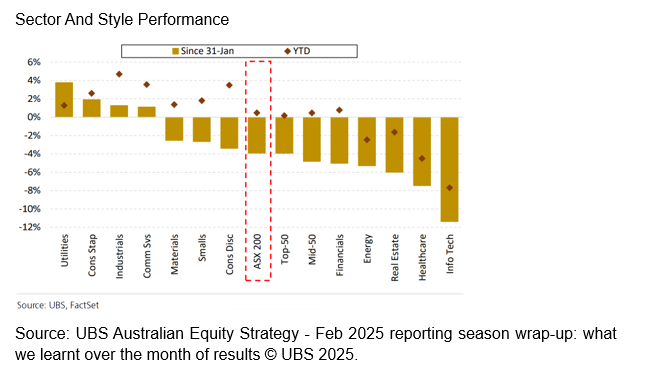

At an aggregate level, earnings per share beat FY25 consensus forecasts by c2%, but led to -1% downgrades for FY26 consensus forecasts, with Energy, Healthcare and Technology driving the bulk of the downgrades.

There was significant bifurcation of share price reactions within each sector, with expectations leading into the results and investor positioning the key determinants of share price moves despite minimal earnings revisions. For example, within Financials, Insurance names Medibank and NIB reacted with share price moves of more than10%, whilst NAB and IAG share prices declined by more than 10%.

The Australian Equities fund fared reasonably well. Key contributors included:

- A2 Milk (Overweight) – The company delivered 10% sales growth in a challenging Chinese Infant Formula market that declined by 6%. They also increased sales guidance for FY25 highlighting management is executing exceptionally well on product innovation, targeted marketing and increasing penetration into tier 2/3 cities.

- WiseTech (Underweight) – WiseTech stock dropped when four independent directors resigned, and Richard White stepped back into the the Executive Chairman role, creating governance issues. The company also announced new product delays and a profit warning. GMG (Underweight) – The stock underperformed post a $4b equity raising to fund data centres, which may have raised concerns about the capital intensity of future developments.

Key detractors included:

- Block (Overweight) – The company delivered a solid 4Q24 result however 1Q25 guidance for 11% GP growth fell shy of expectations relative to FY25 guidance for 15% GP growth.

- IAG (Overweight) – FY25 guidance implied moderating premiums growth in response to moderating claims inflation, resulting in modest downgrades to earnings. Margins remain at the upper end of management guidance.

- Telstra (Underweight) – Telstra delivered a solid 1H25 result with continued strength in their mobiles division and a stabilisation in their ‘Enterprise’ business. They also announced a $750m buyback which will help support the share price in the months ahead.

#2 Unprecedented policy uncertainty causing corporate paralysis

The flurry of US tariff announcements, followed by delays and unwinds have led to corporate investment paralysis in the short term. Sentiment has quickly morphed from US exceptionalism and “making America great” to an increased risk of a slowdown and even potential recession narrative. There could be significant economic pain in the short term in our view, as the US establishes tariffs, cuts immigration and slashes government spending to “re-industrialise” the economy. The second and third order effects of a trade war are also worrying; putting upward pressure on inflation (making it difficult for the Federal Reserve to cut rates), undermining equity markets and consumer confidence.

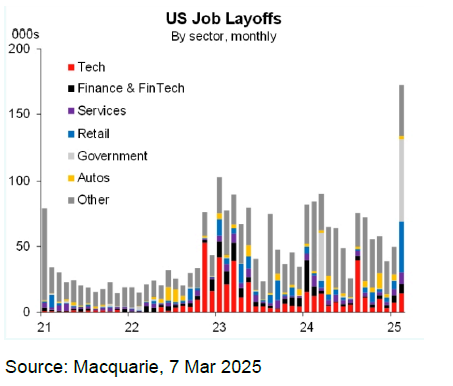

In February 2025, the US recorded the highest number of job cuts (mainly in public sector and retail) since mid 20201. The US Atlanta GDP Nowcast forecasts 1Q25 GDP of -2.4%2, which is highly unusual outside of shocks like Covid, driven by a sharp fall in net exports.

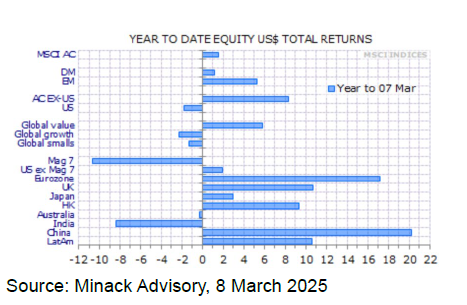

Thus far, markets have responded with significant rotation away from the “Magnificent 7” and other expensive cyclical names. In the year to 7 March 2025, the total market value of the Magnificent 7 have declined by around 10%, whilst Europe and China equity markets have risen by more than 10% as fiscal stimulus is inflecting upwards. Factors such as Growth and Momentum which worked well in 2024 have also taken a back seat to Value and Low volatility. This is apparent in both US and Australian markets, and we expect this rotation to continue as long as the overhang of policy uncertainty remains.

#3 Australian economy entering recovery phase

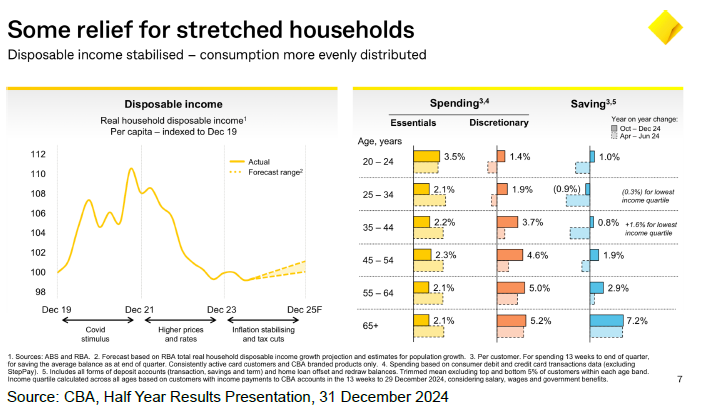

Australia is recovering from a modest cycle slowdown. GDP growth over the year to December was 1.3%, up from 0.8% over the year to September. GDP per capita is rising and households are spending more across all age categories. Discretionary spending has rebounded faster than Essentials. This was evident in CBA’s results presentation below.

The RBA also trimmed interest rates by 25bps to 4.1% in February 2025, possibly marking the start of an easing monetary cycle. However, the RBA minutes suggest a hawkish stance to the rate cut, as it was “not committing the Board to ease policy further” and there was “caution about the prospect of further policy easing.”

We see a muted recovery ahead as consumers remain price conscious, are looking to rebuild savings and tax and interest payable are still acting as a break on spending power. Meanwhile, the Australian economy remains on public sector life support. Public spending rose 5.7% YoY and contributed 1.4 ppt to annual economic growth of 1.3%.

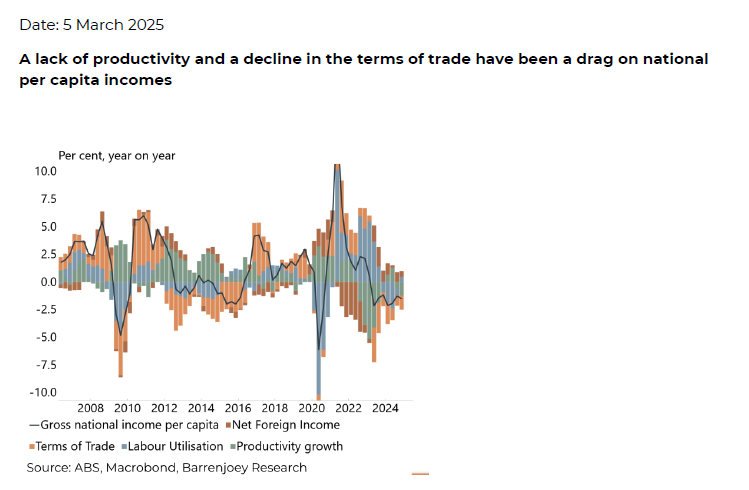

Importantly productivity remains weak and an acceleration in unit labour cost growth suggests that the labour market is tight which may add to persistent services inflationary pressures.

For further details on fund positioning please refer to the Paradice Australian Equities Quarterly Fact Sheet.

1Our World in Pictures, Macquarie, 7 March 2025

2Federal Reserve Bank of Atlanta, GDPNow, 6 March 2025

Disclaimer:

This material is prepared by Paradice Investment Management Pty Ltd (ABN 64 090 148 619 AFSL No 224158) (Paradice, we or us) to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information.

This material is not intended to constitute advertising or advice (including investment advice or security, market or sector recommendations) of any kind. In addition, this material represents only the views of the Paradice Australian Equities team as at the time of release and is not intended, and may not, represent the views of Paradice or any of the other investment teams at Paradice.

Equity Trustees Limited (ABN 46 004 031 298, AFSL No. 240975) (Equity Trustees) is the responsible entity of, and issuer of units in, the Paradice Australian Equities Fund (Fund). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX:EQT).

It may contain certain forward looking statements, opinions and projections that are based on the assumptions and judgments of Paradice with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Paradice. Because of the significant uncertainties inherent in these assumptions, opinions and judgments, you should not place undue reliance on these forward looking statements. For the avoidance of doubt, any such forward looking statements, opinions, assumptions and/or judgments made by Paradice may not prove to be accurate or correct. You should perform your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. Specific securities identified herein are not representative of all securities purchased, sold, or recommended by the Fund previously or in the future. Following publication of this material, the investment teams at Paradice may transact or continue to transact in any of the securities covered herein, and may be positive, negative or neutral at any time hereafter regardless of our initial conclusions, or opinions.

The content of this publication is current as at the date of its publication and is subject to change at any time. It does not reflect any events or changes in circumstances occurring after the date of publication.

You should consider your own needs and objectives and consult with a licensed financial adviser when deciding whether the Fund is suitable for you. Past performance should not be taken as an indicator of future performance. You should also read the current Product Disclosure Statement before making a decision about whether to invest in this product and the Target Market Determination available at www.paradice.com . A Target Market Determination is a document which describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. This material is not to be copied, reproduced or published at any time without the prior written consent of Paradice. Neither Paradice, Equity Trustees, nor any of their respective related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained in this publication or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material.

Copyright© 2025 Paradice