Report: Why is the Iron Ore Price so High?

- Published

Shifting from being underweight to overweight iron ore has been a significant change in the Paradice Australian Equity portfolio over the last 3 months.

Iron ore price resilience has surprised many market watchers during the course of 2023. A weak Chinese economy still struggling with the economic after effects of pandemic related lockdowns and a dire property market outlook had many of us expecting iron ore prices to be sub US$100 by year end. Instead iron ore prices have rallied hard through what is typically a seasonally weak third quarter to a current year high of US$136 per tonne.

So what’s happened?

In large part, the demand strength in iron ore relates to the build out of energy transition infrastructure and strong machinery manufacturing outweighing the negative demand effects of lower residential property construction and decelerating growth rates in traditional areas of fixed asset investment like roads and bridges. As an example, China is currently adding the equivalent of Australia’s entire solar panel installations base every 6 to 8 weeks and is the world’s largest installer of wind turbines used to generate renewable energy. Whilst the manufacture of solar panels themselves is not steel intensive the energy related infrastructure enabling the tying in of renewable energy sources into the grid does use a lot of copper, aluminium and steel.

The shift in steel demand from construction to machinery and energy related infrastructure has also led to a change in demand for the type of steel required to manufacture those products. Construction requires large amounts of long steel whilst machinery requires large amounts of flat steel. Long steel is made in Electric Arc Furnaces using huge amounts of scrap metal. Flat steel is made in blast furnaces and requires iron ore and coking coal as key ingredients.

In essence what we have seen is aggregate steel demand broadly stable over 2023 but a significant change in the composition of the type of steel made during the year which has favoured iron ore focused steel making processes rather than scrap metal processes. This has led to incrementally stronger demand for iron ore and weaker demand for scrap.

On the iron ore supply side, we have seen only modest increases in exports from higher cost jurisdictions like India and other parts of Asia and Europe. Thus stronger iron ore demand has not been offset by incremental supply ultimately leading to higher iron ore prices.

What now?

China’s economic malaise looks be persisting in the short term given the Chinese government’s inability to kickstart domestic consumption. What is changing though is the Chinese government’s desire to stimulate economic activity with a raft of pro-growth policies implemented during the past three months. These policies are increasingly reverting to the commodity intensive growth model of old and are aimed at supporting property construction, the continued build out of critical infrastructure as well as putting a floor under domestic consumer confidence which has hampered consumption to date.

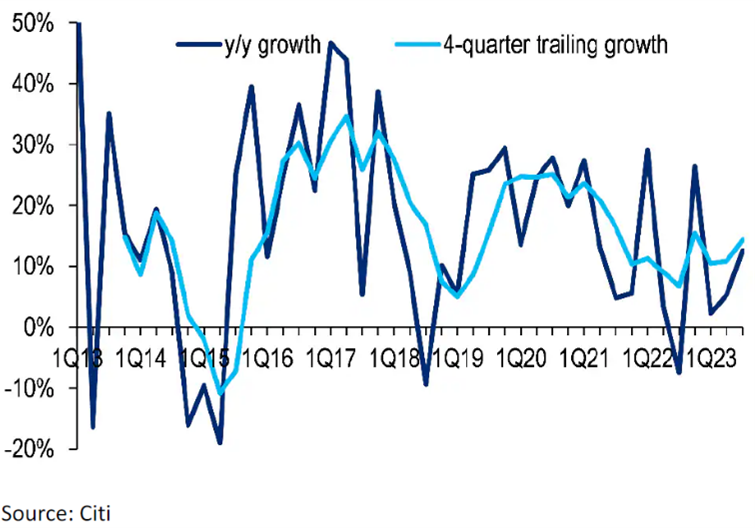

We are seeing lead indicators of Chinese commodity intensive demand currently inflecting higher which bodes quite well for iron ore and bulk commodity prices into 2024 as well as the earnings and dividend generating ability of our largest miners BHP, Rio Tinto and Fortescue. Whilst iron prices at US$136 are unlikely to be sustainable into 2024 anything over US$100 means our big miners will be delivering strong returns from the iron ore gift that keeps on giving.

In our view, at iron ore prices of US$100 and above BHP and Rio Tinto can sustain dividend yields of 6% and greater even despite a relatively heavier capital expenditure period in the years ahead. Any inflection or re-acceleration in global growth will also support other portfolio commodities like copper and aluminium which are significant contributors to BHP and Rio Tinto earnings respectively and is another reason both stocks feature in the Paradice Australian Equity portfolios.

Chinese Construction Company Order Intake

As of 7 December 2023

Disclaimer:

This material is prepared by the Paradice Australian Equities strategy team at Paradice Investment Management Pty Ltd (ABN 64 090 148 619 AFSL No 224158 ) (Paradice, we or us).

This material is not intended to constitute advertising or advice (including investment advice or security, market or sector recommendations) of any kind. In addition, this material represents only the views of Australian Equities team as at the time of release and is not intended, and may not, represent the views of Paradice or any of the other investment teams (including the small caps, mid caps and global teams at Paradice).

This material is not to be copied, reproduced or published at any time without the prior written consent of Paradice. In no event should Paradice or any affiliated party be liable for any direct or indirect trading losses caused by any information in this material. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. Following publication of this material, the investment teams at Paradice may transact or continue to transact in any of the securities covered herein, and may be long, short, or neutral at any time hereafter regardless of our initial conclusions, or opinions.

The information and opinions contained herein, including information obtained from third party sources which are considered to be reliable, are not necessarily all inclusive and, as such, no representation or warranty, express or implied, is made as to the accuracy, completeness or reasonableness of any assumption contained herein and no responsibility arising for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Paradice, its officers, employees or agents.

Any rates of return, forecasts or estimates contained in this publication are not guaranteed. It is of a general nature only and was current only at the time of initial publication.

Copyright© 2023 Paradice