Paradice Australian Equities Fund July 2025 Commentary

Market Review

The S&P/ASX 300 Total Return Index continued to rise, up by 2.4% over July 2025. The S&P500 Total Return Index meanwhile rose 2.2% (in USD) during the month.

Global trade relationships and tariffs remained a moving target as the USA attempted to finalise negotiations ahead of the 1 August 2025 deadline. The USD mounted a +3.2% recovery during the month whilst gold was flat (in USD).

Across the ASX200, investors rotated from financials (-1.0%) towards materials (+4.1%) and healthcare (+9.1%). These trends were broadly consistent in the USA.

The Federal Reserve held interest rates steady despite pressure from Trump, citing inflation concerns and uncertainty around tariff implications. The RBA also surprisingly held interest rates steady in July, preferring to adopt a wait and see approach.

We now expect interest rate cuts sooner rather than later for both countries, with the USA subsequently posting large negative revisions to employment data and the Australia CPI coming in at +0.7% with broad-based disinflation across goods and services.

Performance

The Paradice Australian Equities Fund was up 27bps net of fees versus the benchmark for the month of July 2025. Top 3 contributors were Commonwealth Bank (underweight), Newmont (overweight) and ResMed (overweight). Top 3 detractors were CSL (underweight), Treasury Wine Estates (overweight) and Northern Star (overweight).

Noteworthy industry / macro developments

#1 Tariff negotiations wrapping up, impact on real economy getting started

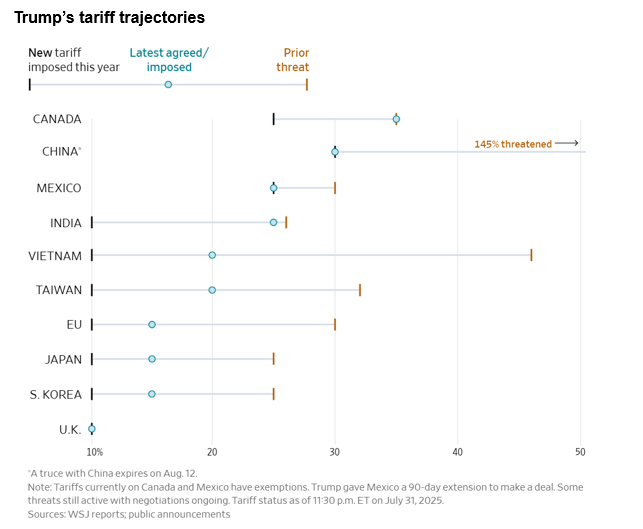

Trump’s self-imposed 1 August 2025 deadline for wrapping up tariff negotiations has passed, and with it, we expect flow-on impacts on consumers and corporates to materialise for the balance of 2025. In most instances tariff increases were reduced from “Liberation Day” scoreboard expectations, e.g. the tariff on the EU was reduced from 30% to 15%, and the tariff on China was reduced from 145% to 30%. Baseline tariffs on most countries amounted to 15% (up from 10%). Canada and Brazil saw higher tariffs vs original expectations, with tariffs now set at 35% and 50% (compared to April 2 expectations of 25% and 10%).

By sector, steel, aluminium and copper imports to the US face a 50% tariff (albeit the copper tariff does not apply to the raw material). Auto parts and vehicles attract a 25% tariff, albeit goods covered under the USMCA agreement are exempt, and cars from countries South Korea and Japan face 15% tariffs. Trump is also targeting 200% tariffs for pharmaceutical imports, however, this would only come into effect after 18 months depending on whether there was sufficient reshoring to the US.

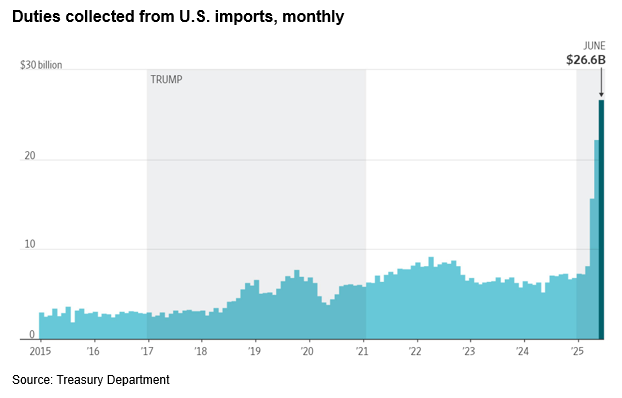

Duties collected from USA imports have risen sharply from <US10b per month (from 2015 to Q1 2025) to cUS$27b in June-25. This figure is likely to rise post 1 August

2025 tariff imposition. Whilst this goes some way to offset the cUS$2tr annual fiscal deficit, it is likely to be borne by a combination of consumers (who will have to pay more), corporates (intermediaries / retailers sacrificing profits), and the manufacturers (from the source country).

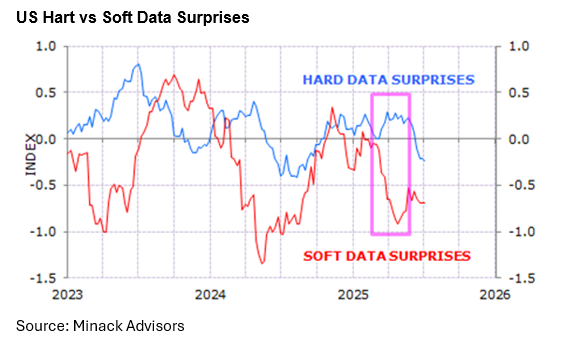

While sentiment and survey data have been soft, hard data thus far has surprised to the upside. In our view, the hard data is yet to reflect the tariffs, given they have been delayed until now and there was significant pull forward of demand.

As such, we still expect US inflation to tick up and US corporates to signal weaker demand for the balance of 2025.

#2 Reporting season expectations

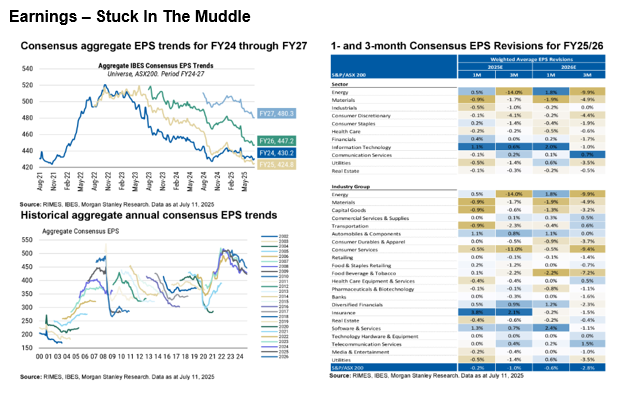

Consensus is currently forecasting -2% and +5% EPS growth in FY25 and FY26 respectively.

Overall FY26 EPS earnings have been revised -3% over the last 3 months, most notably in energy, materials and consumer discretionary, which is not surprising given they are conceivably most impacted by tariffs. Industrials, communications and real estate have seen near neutral impacts.

We expect Australian housing to show signs of green shoots, particularly in Victoria, as consumer confidence improves on the back of RBA rate cuts, albeit affordability remains challenged.

We also expect better clarity around how Australian corporates intend to navigate tariff impacts. Thus far there have been wide ranging intentions with respect to diversification of supply chains and pricing actions, depending on 1) source of manufacturing; 2) market share within the product segment; and 3) relativity of market share compared to competitors.

Our largest sector skews in the portfolio are underweight financials and overweight consumer staples, communication services, and materials.

For further details on fund positioning please refer to the Paradice Australian Equities Quarterly Fact Sheet.

Disclaimer:

This material is prepared by Paradice Investment Management Pty Ltd (ABN 64 090 148 619 AFSL No 224158) (Paradice, we or us) to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information.

This material is not intended to constitute advertising or advice (including investment advice or security, market or sector recommendations) of any kind. In addition, this material represents only the views of the Paradice Australian Equities team as at the time of release and is not intended, and may not, represent the views of Paradice or any of the other investment teams at Paradice.

Equity Trustees Limited (ABN 46 004 031 298, AFSL No. 240975) (Equity Trustees) is the responsible entity of, and issuer of units in, the Paradice Australian Equities Fund (Fund). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX:EQT).

It may contain certain forward looking statements, opinions and projections that are based on the assumptions and judgments of Paradice with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Paradice. Because of the significant uncertainties inherent in these assumptions, opinions and judgments, you should not place undue reliance on these forward looking statements. For the avoidance of doubt, any such forward looking statements, opinions, assumptions and/or judgments made by Paradice may not prove to be accurate or correct. You should perform your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. Specific securities identified herein are not representative of all securities purchased, sold, or recommended by the Fund previously or in the future. Following publication of this material, the investment teams at Paradice may transact or continue to transact in any of the securities covered herein, and may be positive, negative or neutral at any time hereafter regardless of our initial conclusions, or opinions.

The content of this publication is current as at the date of its publication and is subject to change at any time. It does not reflect any events or changes in circumstances occurring after the date of publication.

You should consider your own needs and objectives and consult with a licensed financial adviser when deciding whether the Fund is suitable for you. Past performance should not be taken as an indicator of future performance. You should also read the current Product Disclosure Statement before making a decision about whether to invest in this product and the Target Market Determination available at www.paradice.com . A Target Market Determination is a document which describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. This material is not to be copied, reproduced or published at any time without the prior written consent of Paradice. Neither Paradice, Equity Trustees, nor any of their respective related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained in this publication or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material.

The information and opinions contained herein, including information obtained from third party sources which are considered to be reliable, are not necessarily all-inclusive and, as such, no representation or warranty, express or implied, is made as to the accuracy, completeness or reasonableness of any assumption contained herein and no responsibility arising for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Paradice, its officers, employees or agents.

Copyright© 2025 Paradice