International Small Cap

Overview

The Paradice International Small Cap Strategy was established in October 2020 and applies the philosophy and process of the Global Small Mid Cap Strategy (launched August 2010). The team is comprised of five investment professionals including Co-Portfolio Managers, Paul Mason and Toby Shute.

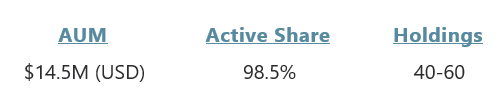

The Strategy typically invests in 40-60 well-capitalized businesses that the team believes are undervalued relative to the quality of the franchise.

The team believe minimizing downside in volatile markets is critical in positioning the strategy to have the opportunity to compound investor capital when markets recover. They intend for this combination of undervaluation and thoughtful risk management to create the opportunity for double digit compounding and outperformance of the benchmark over longer time horizons.

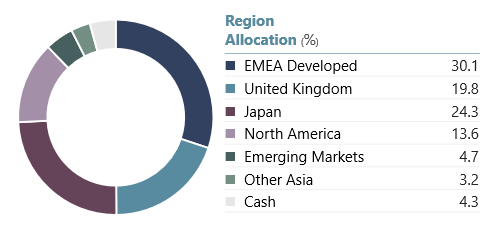

Strategy Details (as of 06/30/2025)

Strategy characteristics, including allocations are those of the Paradice International Small Cap Strategy and are provided for informational purposes only as of the date shown only. Actual characteristics and allocations may vary significantly over time. Active Share is a statistic used to measure the percentage of the portfolio that differs from a benchmark index (MSCI World ex USA Small Cap Net Total Return Index), with 100% implying no overlap with the benchmark and 0% implying total overlap.

Philosophy and Process

The team aims to capitalize on inefficiencies in the international small cap space by uncovering competitively advantaged businesses trading at substantial discounts to their determination of intrinsic value. Employing a fundamental, bottom-up investment process, they construct a portfolio of 40-60 international businesses outside the U.S. characterized by enduring business models, sound balance sheets, and adept management. Their approach is benchmark agnostic. And while country and sector allocations are largely the outcome of the team’s stock selection process, the portfolio manager consciously diversifies across geographies and industries.

The team invests with a long-term view with a business owner mentality, seeking involvement to influence outcomes, and will proactively pursue dialogue with portfolio companies. Engagement on perceived risks and opportunities supports their objective to grow intrinsic value while thoughtfully managing risk.

Why International Small Caps

The international small cap space is vast and relatively under-researched by both buy- and sell-side participants, leading to market inefficiencies and the potential to uncover attractive investment opportunities.

Smaller company sizes often lead to increased access to management for bottom-up, fundamental investors with significant shareholdings. Where outcomes may be meaningful or material, Paradice seeks to leverage such access and actively engage to impact environmental, social and governance policies/practices and improve business value.

International small cap equities, in the team’s view, offer numerous potential benefits for capital allocators including diversification, alpha generation opportunities for active managers and the potential for attractive investment returns. Historically, small cap equities have outperformed their larger cap peers, particularly when investing in portfolios of quality, undervalued small-cap businesses.

Portfolio Management

Kevin Beck, CFA

Kevin joined Paradice in 2009. Prior to joining Paradice Kevin was a Senior Analyst on the Artisan Partners International Value and Global Value investment funds. Prior to Artisan, he was Co-Portfolio Manager of the Denver Investment Advisors International Small Cap Equity Fund. He has also worked at Harris Associates and JPMorgan/Fleming. Kevin has over 32 years of investment experience in the US, UK and Brazil. He is a Chartered Financial Analyst and holds a Masters of Finance from the University of Wisconsin.

Toby Shute

Toby joined Paradice in October 2015. Prior to Paradice, Toby with Centaur Capital Partners, a value-oriented, long-biased investment advisor. Prior to Centaur, he worked for The Motley Fool as both an Analyst on a special situations-focused investment newsletter and as a Contract Writer/Analyst for Fool.com. Toby has over 17 years of financial services industry experience. Toby holds a BA from Rice University.

Paul joined Paradice in February 2010 as a Trader working closely with the Australian Small Cap Team. In 2013 Paul joined the Global Equity team in the role of Analyst, subsequently taking on a portfolio management roles in 2019 and 2023. Prior to Paradice, he was employed at KPMG in the Business Advisory and Taxation division. Paul has over 15 years of experience in the asset management industry. Paul holds a Commerce degree with majors in Accounting, Finance and Business Law from the University of Wollongong, Australia.