Global Small Mid Cap

Overview

The Paradice Global Small and Mid Cap Strategy was established in August 2010 and is managed by Portfolio Managers, Kevin Beck and Paul Mason. The team is comprised of four investment professionals including Kevin and Paul.

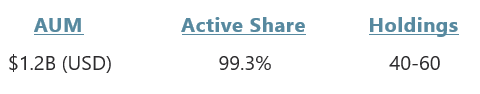

The Strategy aims to outperform its respective benchmark over an economic cycle by investing in well-capitalized, competitively advantaged businesses the team believes are undervalued relative to the quality of the enterprise. The Strategy typically invests in 40-60 securities, is unconstrained regarding allocations to countries or industries, and is benchmark agnostic.

The team believe minimizing downside in volatile markets is critical in positioning the strategy to have the opportunity to compound investor capital when markets recover. They intend for this combination of undervaluation and thoughtful risk management to create the opportunity for double digit compounding and outperformance of the benchmark over longer time horizons.

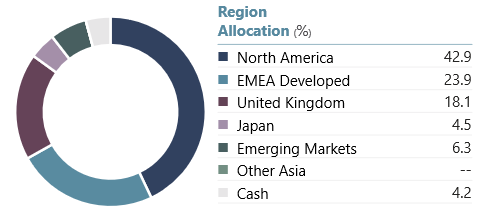

Strategy Details (as of 06/30/2025)

6/30/2025 Strategy Factsheet

Strategy characteristics, including allocations are those of a representative account, and are provided for informational purposes only as of the date shown only. Actual characteristics and allocations may vary significantly over time. Active Share is a statistic used to measure the percentage of the portfolio that differs from a benchmark index (MSCI ACWI SMID Cap Net Total Return Index in this instance), with 100% implying no overlap with the benchmark and 0% implying total overlap.

Philosophy and Process

The team aims to capitalize on inefficiencies in the global small mid cap space by uncovering competitively advantaged businesses trading at substantial discounts to their determination of intrinsic value. Employing a fundamental, bottom-up investment process, they construct a portfolio of 40-60 global businesses characterized by enduring business models, sound balance sheets, and adept management. Their approach is benchmark agnostic. And while country and sector allocations are largely the outcome of the team’s stock selection process, the portfolio managers consciously diversify across geographies and industries.

The team invests with a long-term view with a business owner mentality, seeking involvement to influence outcomes, and will proactively pursue dialogue with portfolio companies. Engagement on perceived risks and opportunities supports their objective to grow intrinsic value while thoughtfully managing risk.

Why Global Small Mid Caps

The global small/mid cap space is vast and relatively under-researched by both buy-side and sell-side participants, leading to market inefficiencies and the potential for attractive investment opportunities.

Global small and mid cap equities, in the team’s view, offer numerous potential benefits for capital allocators including diversification, alpha generation opportunities for active managers, and the potential for attractive investment returns. Historically, small cap equities have outperformed their larger cap peers, particularly when investing in portfolios of quality, undervalued small/mid cap businesses.

Portfolio Management

Kevin joined Paradice in 2009. Prior to joining Paradice he was a Senior Analyst on the Artisan Partners International Value and Global Value investment funds. Prior to Artisan, he was Co-Portfolio Manager of the Denver Investment Advisers International Small Cap Equity Fund. He has also worked at Harris Associates and JPMorgan/Fleming. Kevin has over 32 years’ investment experience in the US, UK and Brazil. He is a CFA® charterholder and has an MS in Finance from the University of Wisconsin.

Paul joined Paradice in February 2010 as a Trader working closely with the Australian Small Cap Team. In 2013 Paul joined the Global Equity team in the role of Analyst, subsequently taking on a portfolio management roles in 2019 and 2023. Prior to Paradice, he was employed at KPMG in the Business Advisory and Taxation division. Paul has over 15 years of experience in the asset management industry. Paul holds a Commerce degree with majors in Accounting, Finance and Business Law from the University of Wollongong, Australia.