May 15, 2025

Q&A with All Cap Portfolio Manager, Munish Malhotra

Global and International All Cap Strategies

Brittany Meisner, Director of Institutional Distribution, North America, sat down with Munish Malhotra to discuss his thoughts and ideas behind setting up the Global All Cap and International All Cap strategies at Paradice Investment Management LLC.

Key Takeaways:

High-Conviction, Differentiated Portfolios

Paradice’s Global and International All-Cap strategies are concentrated (<35 holdings), benchmark-agnostic (>90% active share 1, and built to express focused, long-term investment views—avoiding over-diversification and closet indexing with a singular focus to deliver alpha.

Disciplined, Fundamentals-Based Approach

We prioritize deep research and bottom-up stock selection, focusing on quality founder led businesses with clear competitive advantages, sound fundamentals, and reasonable valuations—while intentionally avoiding macro and sector-level speculation. Additionally, we pride ourselves on finding and leaning into “misfit toys” in the market that tend get overlooked by peers.

Experienced, Versatile Investment Leadership

Backed by over two decades of global equity experience, our investment approach blends value, quality, and momentum, expanding Paradice’s platform into broader market-cap strategies while staying aligned with our core principles.

1 Active Share is a statistic used to measure the percentage of the portfolio that differs from a benchmark index with 100% implying no overlap with the benchmark and 0% implying total overlap.

Q&A

Q: You joined Paradice in 2023. What attracted you to Paradice?

I joined Paradice because their values and investment philosophy closely align with my own. We believe in the power of long-term compounding to drive returns for our clients. We are fundamental investors, seeking high quality businesses with strong balance sheets and adept management teams. We work collaboratively as a research team, working to identify underappreciated opportunities.

Paradice’s existing strategies address the Small/SMID-cap space globally and internationally. My experience across all market caps made launching All-Cap strategies a natural fit, enhancing our range and offering clients more complete solutions.

Q: When you joined Paradice, you were given the opportunity to create two products from the ground up. What were the key points of consideration that went into designing the strategies?

First and foremost, I wanted to create strategies that I was excited about managing, aligned with my investment philosophy and that leveraged my strengths and experience as an investor. Our goal as a firm was to develop solutions meeting investors’ evolving needs, particularly in underrepresented areas, while complementing Paradice’s offerings.

We identified meaningful gaps within the Global and International All Cap active equity universe. Investors can achieve broad market exposure efficiently through cost effective index-based or quantitative solutions, and many active portfolios closely track benchmarks – often with active share below 90% – blurring the line between active and passive. We see limited value in replicating index-like exposure at active management fees.

In contrast, our new portfolios are intentionally concentrated, targeting over 90% active share with fewer than 35 holdings. This helps to avoid overdiversification and enhances our ability to express high-conviction views. Our unconstrained approach – spanning market caps and geographies, including emerging markets – allows us to target what we see as compelling opportunities, offering distinct exposures for diversification. This concentration suits our small, nimble team, enabling deep fundamental research and oversight. This reflects our conviction that true active management should deliver meaningful differentiation and potential excess return – not just broad market exposure.

Q: What about you and your background make you the right person for this role? Where is your value add versus other managers out there?

Early in my investment career, I felt like an underdog. Born to first-generation immigrant parents in the midwestern part of the US, I pursued a medical scholarship in college, driven by a passion for science. This scientific background fueled my curiosity, a key trait for investing in my opinion. I consistently research companies, analyzing their business models, financials, and management, while seeking industry insights. For me, investing is a treasure hunt for hidden gems, and this underdog mentality and curiosity have shaped my 25-year career.

Additionally, mentored by distinguished investors, I blended diverse styles into a cohesive philosophy. At Driehaus Capital, as a junior analyst, I learned momentum and growth investing. At Marsico Capital, as a senior analyst and global portfolio manager, I focused on high-quality, innovative industry leaders. At Cambiar Investors, I integrated quality, value, and catalysts. This fusion of styles defines my approach as a global equity investor.

Q: How would you describe your investment philosophy?

I believe that growth, quality, and value are not mutually exclusive ideas and that all styles have their strengths and shortcomings. My approach blends quality, value, and momentum aiming to capture the strengths of each style while minimizing their weaknesses.

First, we look for companies that are attacking large addressable market opportunities and have a long runway to grow. Second, we want a business where we see a discernible competitive advantage that is relatively easy to understand. The fewer the degrees of complexity the better.

Third, we prefer companies that are founder-led, and/or founder owned. We’ve found that many our most successful investments since inception have come from founder-led companies. In our experience, founders tend to be maniacally obsessed with providing their customers with better products/services each year thereby strengthening their competitive advantage and the durability of their business.

Fourth, while we care about valuation, we don’t screen for “cheap” stocks. Instead, we evaluate what the market is pricing in for future growth from today’s stock price compared to what we feel a company can comfortably deliver. If there’s a wide gap between the market’s expectations and our expectations, that’s our margin of safety. We also look for “free call options”- new product lines/service opportunity, untapped geographic opportunities, cash or investments on the balance sheet, etc.

Finally, we look for momentum – not just in price, but in business performance: earnings revisions, meeting or beating expectations, rising insider buying activity, etc. Rather than trying to catch a falling knife and risk capital loss or opportunity cost we want businesses that are moving in the right direction before we invest.

Q: You stress that a part of your investment philosophy is you try hard to ignore macro calls, sector bets, etc. Why is that?

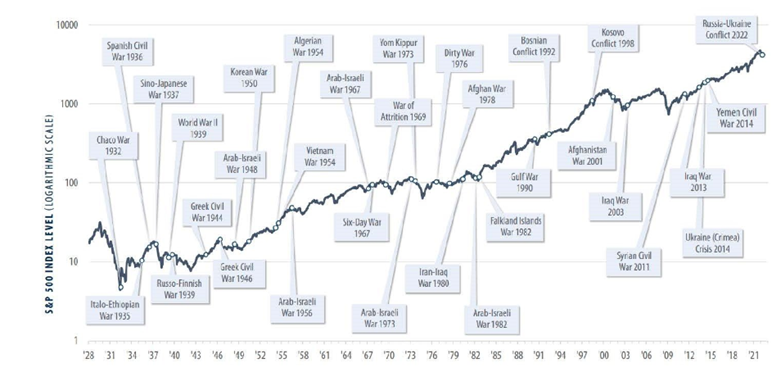

As I look back on my career, I’ve been involved in countless investment meetings that devolve into macro speculation: the direction of interest rates, unemployment, inflation, GDP, geopolitics, commodity prices, and so on. Frankly, 99% of the time it’s just noise. One of my favorite charts to refer to goes back to 1925 with major historical conflicts and events overlaid with the stock market. It shows that while short-term volatility is inevitable, the key to long-term success is owning exceptional businesses that consistently gain market share. That’s where I focus – not on predicting the next macro event.

(Source: S&P, CapIQ, Bloomberg)

Q: What is different about your strategies versus competitors out in the market?

First, we’re not afraid to stray from the herd. We actively manage and concentrate on our best ideas with our top 10 names regularly accounting for 35-50% of the portfolio. We don’t obsess over tracking error – we’re after alpha, not conformity.

The second difference comes from our collection of “Misfit Toys” in the portfolio. This term was used in the movie Moneyball and referred to athletes that were overlooked and undervalued because teams didn’t like their unconventional “quirks”. We look for companies that may have quirks – odd structures, past underperformance, eccentric founders, or poor quality screens – that result in mispricing. These companies often get ignored or under owned by many institutional investors as few want to risk their professional reputation by recommending a quirky investment. We lean in, provided the fundamentals are sound and they still meet our philosophical criteria. Of course, we own our share of “all-star athletes” but the difference between us and many in our industry is our willingness to also look hard at these “misfit” companies.

Q: Can you give us an example of a “Misfit Toy” in your portfolio?

Formula One is a perfect example. We’ve held it since the inception of both strategies. I spent some time researching the business a few years ago and found that Formula One screens poorly as a stock for several reasons; an odd corporate structure, the stock screens poorly for “quality” because earnings are artificially depressed and lastly a short history as a public company. But we saw a unique opportunity.

We liked the fact that the global addressable market for live sports is large and growing especially as younger generations prefer experiences and live events over luxury goods and discretionary items. These are scarce assets – just like the NFL, NBA or any other sport, there’s only one Formula One and we get to own the “league” rather than individual teams. The senior members of the parent company Liberty Media are not only on the board but also have a meaningful ownership stake in the company. Because of the “quirks” mentioned earlier, the stock was trading at an attractive valuation. As of the end of April 2025, it has been a positive contributor for both strategies since inception.

Q: What excites you about the future?

The one constant in the world is change. Almost every way we interact with the world is drastically different than it was a decade ago – how we communicate, work, travel, dine, entertain, save, spend. It feels like we are living in a time where disruption is celebrated, innovators are challenging large legacy incumbents, and it is happening at a very rapid pace.

I still get thrills watching SpaceX launch and re-land rockets back to Earth like something out of a Sci-Fi movie. Before Airbnb I never dreamt of using our phones to book someone’s house for the weekend. Uber was founded in 2009 and now I can’t remember the last time I took a taxi. Doordash started in 2013 and now my family uses the service every week. I think a lot about gene editing, artificial intelligence and quantum computing and the implications for society over the next decade.

These anecdotes of constant change and evolution are what excite me about the future because I see opportunities for businesses and investors at every turn.

Currently, there’s an extreme concentration of the S&P 500 in the top 6 to 7 companies and no one can imagine a world where these companies aren’t dominant. Only 3 of the top companies from 2010 are still in the top 10 today. Globally, just two have persisted. Seven years ago, Nvidia was a mid-cap.

We believe the next Nvidia is out there now being overlooked and “under” researched due to all the focus on the Mag 7. Our portfolio companies reflect this theory – Doordash started in 2013 and has become a household utility with a significant opportunity for online delivery. Mercadolibre and SEA Holdings, given their dominance in ecommerce within the respective regions, have the potential to be juggernauts over time. Lam Research’s equipment is critical to making semiconductors for artificial intelligence, autonomous vehicles, advanced defense equipment, etc. Applovin’s software is disrupting a significant online advertising opportunity. Apollo Management is quickly challenging large legacy incumbent banks for a seat as a dominant capital provider to corporations.

What’s even more interesting is the constant changes we’re seeing aren’t concentrated in one sector or part of the world economy, giving way to even more opportunities across both industries and geographies. That’s why we keep our investable universe broad and our minds open. We think this is a great time to scout for and invest in rookies with the potential to be future all-stars.

Disclaimer:

Information contained herein is intended for institutional and other qualified investor use only. This includes such audiences as described here: https://www.paradice.com/international/important-disclosures/. This material is prepared by Paradice Investment Management LLC (Paradice, we or us). This material may not be reproduced or redistributed in any format without the approval of Paradice.

Material contained herein is provided solely for information purposes and is not, and may not be relied on in any manner as legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy the investment advisory services of Paradice nor is it intended to constitute advertising or advice (including any particular security, market or sector recommendations) of any kind.

It should not be assumed that any investment in the examples described or investments mentioned therein have been or will ultimately be profitable, or that recommendations made in the future will be profitable.

In addition, this material represents only the views of the relevant investment team at the time of release and is not intended, and may not, represent the views of Paradice or any of the other investment teams at Paradice. It does not reflect any events or changes in the circumstances occurring after the date of publication. Following publication of this material, the investment teams at Paradice may transact or continue to transact in any of the securities covered herein, and may be positive, negative or neutral at any time hereafter regardless of our initial conclusions, or opinions.

This material may contain certain forward looking statements, opinions and projections that are based on the assumptions and judgments of Paradice with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Paradice. Because of the significant uncertainties inherent in these assumptions and judgments, you should not place undue reliance on these forward-looking statements, nor should you regard the inclusion of these statements as a representation by Paradice that the objectives of any Paradice strategy mentioned herein will be achieved. Except where otherwise indicated, the information provided herein is based on matters as they exist as of date of preparation, not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. For the avoidance of doubt, any such forward looking statements, opinions, assumptions and/or judgments made by Paradice may not prove to be accurate or correct. You should perform your own research and due diligence, and consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

Neither Paradice nor any of their respective related parties, directors, officers or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information, including that from third party sources, contained in this publication or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material.

The benefits of advisory services are subject to various risks, including the advisor’s ability to accurately assess market conditions, select appropriate investments, and manage the portfolio effectively. Poor advisory decisions can result in suboptimal investment performance.

Audience:

Information contained herein is intended for institutional and other qualified investor use only. This includes such audiences as described here: https://www.paradice.com/international/important-disclosures/.

Definitions:

Definitions of terminology used can be found here: https://www.paradice.com/international/important-disclosures/.

Copyright © 2025 owned by Paradice Investment Management LLC. All rights reserved.

Munish Malhotra, CFA

Portfolio Manager, Global and International All Cap strategies

Brittany Meisner, CFA, CAIA, CIPM

Director, Institutional Distribution, North America